Categorization

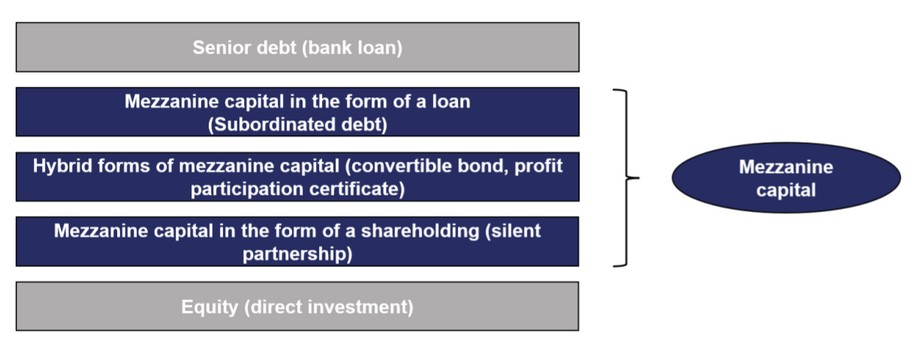

The term «mezzanine» originates from architecture and describes a middle floor between two main floors. In corporate financing, mezzanine capital characterizes a hybrid type of financing that occupies a position between equity and debt. In the case of mezzanine financing, the company in question generally receives equity on the balance sheet, for which, however, neither influence nor residual rights are granted to the capital providers. Depending on its form and structure, mezzanine capital has either more equity or more debt character.

Aims & Functions

The aim of mezzanine capital is to close the financing gap between equity and debt. On the one hand, borrowing can generate a short-term cash inflow if additional debt capital can no longer be raised due to a lack of creditworthiness. On the other hand, mezzanine financing also serves to improve creditworthiness in the medium and long term, provided that the additional capital is classified as equity on the balance sheet.

Typically, mezzanine capital is used in capital-intensive industries to finance the growth of SMEs, such as acquisitions, the expansion of product lines, the establishment of new distribution channels or plant expansions. Other situations in which mezzanine financing is resorted to include restructurings, real estate projects or leveraged buy outs (LBOs) by private equity firms. An important prerequisite for raising mezzanine capital is a positive cash flow profile of the company so that the demands of the capital providers can be serviced.

Characteristics

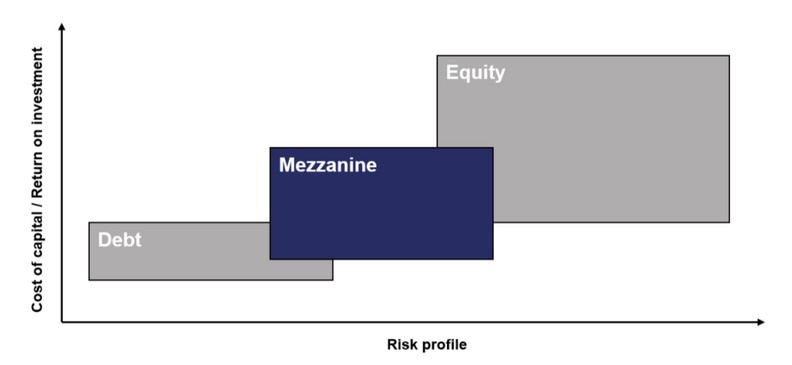

The risk profile and cost of capital of mezzanine capital as a hybrid form of financing are between those of equity and debt. Mezzanine capital is less risky for the investor than equity capital due to its priority in the event of bankruptcy and the fact that interest payments can be planned more easily and is therefore associated with lower expected returns.

The structuring of mezzanine financing is manifold and individual. However, all forms of mezzanine capital have the following basic characteristics:

· Seniority to equity capital; Subordination to debt capital.

· Higher capital costs / returns compared to traditional debt capital

· The capital is provided for a limited period – usually six to ten years.

· The fee for the provision of mezzanine capital is typically reported as an operating expense on the investor’s side and is therefore tax-deductible (the exception to this is silent partnerships).

Why mezzanine capital is interesting for SMEs

The decisive advantage of financing via mezzanine capital is its equity-like character due to its subordination. As a rule, this financing alternative is regarded by banks as equity in the balance sheet analysis and rating process. This leads to an improvement in the equity ratio and keeps the credit lines free for borrowing – with improved credit terms due to the higher credit rating. At the same time, however, the raising of mezzanine capital does not lead to a dilution of shares or a restriction of the decision-making freedom of the current shareholders.

In general, the structuring scope for mezzanine capital is greater and less restricted by law than, for example, for equity capital. Accordingly, mezzanine financing can also be structured more flexibly, particularly with regard to the following parameters:

· Type of instrument

· Interest rate

· Term

· Termination option

· Repayment modalities

· Ranking in the capital structure

· Profit or loss arrangements

Entrepreneurs must of course also be aware that mezzanine capital is associated with higher costs than debt capital and that parts of the increase in the value of the company and profits may have to be passed on to the capital provider.

Because no collateral is provided for the raising of mezzanine capital and because the capital provider is highly dependent on the future cash flows of the company, longer and more complex due diligence procedures are required when raising capital. This usually leads to additional, pre-contractual costs.

Conclusion

Mezzanine capital is typically provided by private equity companies, dedicated mezzanine funds or banks and – depending on the structure – has either more equity or more debt character. Particularly for growth financing for SMEs, mezzanine capital represents a genuine alternative to classic forms of financing, as the advantages (but also disadvantages) of debt and equity are bundled in one instrument.

Author: Simon Fabsits, MSc

Dealbridge M&A Advisors Austria & Liechtenstein